a collections of case digests and laws that can help aspiring law students to become a lawyer.

|

|

ISSUE: Whether or not the Court should revisit its ruling in Santiago declaring RA 6735 “incomplete, inadequate or wanting in essential terms and conditions” to implement the initiative clause on proposals to amend the Constitution

FACTS: Lambino et al filed a petition with the COMELEC to hold a plebiscite that will ratify their initiative petition to change the 1987 Constitution under Section 5(b) and (c)2 and Section 73 of Republic Act No. 6735 or the Initiative and Referendum Act. They alleged that their petition had the support of 6,327,952 individuals constituting at least twelve per centum (12%) of all registered voters, with each legislative district represented by at least three per centum (3%) of its registered voters. They also claimed that COMELEC election registrars had verified the signatures of the 6.3 million individuals.The Lambino Group’s initiative petition changes the 1987 Constitution by modifying Sections 1-7 of Article VI (Legislative Department)4 and Sections 1-4 of Article VII (Executive Department) and by adding Article XVIII entitled “Transitory Provisions.” These proposed changes will shift the present Bicameral-Presidential system to a Unicameral-Parliamentary form of government. DECISION: Dismissed RATIO DECIDENDI: The present petition warrants dismissal for failure to comply with the basic requirements of Section 2, Article XVII of the Constitution on the conduct and scope of a people’s initiative to amend the Constitution. There is no need to revisit this Court’s ruling in Santiago declaring RA 6735 “incomplete, inadequate or wanting in essential terms and conditions” to cover the system of initiative to amend the Constitution. An affirmation or reversal of Santiago will not change the outcome of the present petition. Thus, this Court must decline to revisit Santiago which effectively ruled that RA 6735 does not comply with the requirements of the Constitution to implement the initiative clause on amendments to the Constitution.

0 Comments

ISSUE: Whether or Not the provisions of the Constitution, particularly Article XII Section 10, are self-executing.

FACTS: The GSIS, pursuant to the privatization program of the Government under Proclamation 50 dated 8 December 1986, decided to sell through public bidding 30% to 51% of the issued and outstanding shares of the Manila Hotel (MHC). DECISION: Dismissed RATIO DECIDENDI: Yes. Sec 10, Art. XII of the 1987 Constitution is a self-executing provision. A provision which lays down a general principle, such as those found in Article II of the 1987 Constitution, is usually not self-executing. But a provision which is complete in itself and becomes operative without the aid of supplementary or enabling legislation, or that which supplies sufficient rule by means of which the right it grants may be enjoyed or protected, is self-executing. Under the Revised Penal Code Article 12-

The following are exempt f r om criminal liability: 1. An imbecile or an i n s a n e person, u n l e s s the l a t t er has a c t e d during a l u c id interval. When the imbecile or an insane person has committed an act w h i c h the l aw defines as a felony (delito), the court shall order h i s confinement i n o n e o f t h e h o s p i t a l s or asylums e s t a b l i s h e d for p e r s o n s thus afflicted, w h i c h he shall not be permitted t o l e a v e without first o b t a i n i n g t h e permission of the same court. 2. A p e r s o n under n i n e years of age.* (now 15 years of age and under) 3. A p e r s o n over n i n e y e a r s of a g e and under fifteen, unless he has a c t e d w i t h discernment, i n w h i c h case, s u ch minor shall be p r o c e e d e d against i n accordance w i t h the provisions of Article 80 of t h i s Code. (now over 15 years of age and under 18) 4. Any p e r s o n who, w h i l e performing a lawful act with due care, c a u s e s a n injury by m e r e a c c i d e n t w i t h o u t fault or i n t e n t i o n of c a u s i n g it. 5. Any p e r s o n who acts under the compulsion of an i r r e s i s t i b l e force. 6. Any p e r s o n w h o a c t s u n d e r t h e impulse o f a n uncontrollable fear of a n equal or g r e a t e r injury. 7. Any p e r s o n w h o fails t o perform an act required by law, w h e n p r e v e n t e d by some lawful or insuperable cause. *A child fifteen years of age or under is exempt from criminal liability under Rep. Act No. 9344 (Juvenile Justice and Welfare Act of 2006). When s u c h minor i s adjudged t o b e criminally irresponsible, t h e court, in conformity w i t h t h e provisions o f t h i s a n d the preceding paragraph, shall commit him t o t h e care and custody of h i s family w h o shall be charged w i t h h i s surveillance and education; o t h e r w i s e , he shall be committed t o the care of some i n s t i t u t i o n or p e r s o n m e n t i o n e d i n s a i d Article 80.** Source: The Revised Penal Code of the Republic of the Philippines/Juvenile Justice and Welfare Act of 2006. Mala in se and mala prohibita, distinguished.

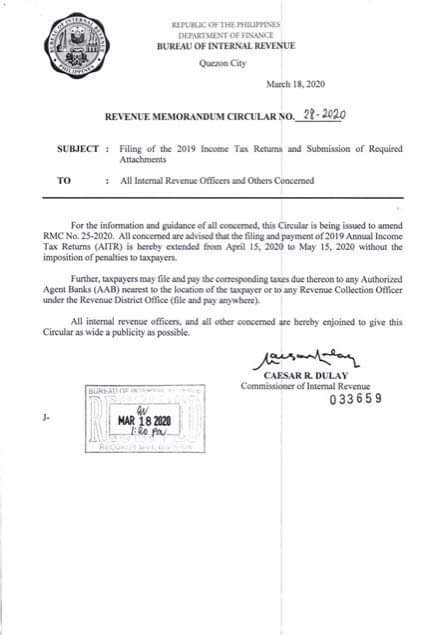

There is a distinction between crimes which are mala in se, or wrongful from their nature, such as theft, rape, homicide, etc., and those that are mala prohibita, or wrong merely because prohibited by statute, such as illegal possession of firearms. Crimes mala in se are those so serious in their effects on society as to call for almost unanimous condemnation of its members; while crimes mala prohibita are violations of mere rules of convenience designed to secure a more orderly regulation of the affairs of society. (Bouvier's Law Dictionary, Rawle's 3rd Revision) REVENUE MEMORANDUM CIRCULAR NO. 28-2020 (EXTENSION OF FILING OF 2019 ANNUAL INCOME TAX RETURN)3/22/2020 G.R. NO. 174238 July 07, 2009

Anita Cheng, Petitioner vs Spouses William Sy and Tessie Sy, Respondents. Facts: Anita Cheng filed two(2) estafa cases before the RTC-Manila against William and Tessie Sy for issuing to her Philippine Bank of Commerce checks no. 171762 and 71860 for P300,000.00 each in payment of their loan, both of which were dishonored upon presentment for having been drawn against a closed account. Petitioner on January 20, 1999, filed against respondents two(2) cases for violation of BP 22 before the MeTC-Manila. On March 16, 2004, the RTC dismissed the estafa cases for failure of the prosecution to prove the elements of the crime. Later, the MeTC dismissed the BP 22 cases on account of the failure of petitioner to identify the accused respondents in open court. On April 26, 2005, petitioner lodged against Sy’s before the RTC- Manila, a complaint for collection for sum of money with damages based on the same loaned amount of P600,000.00 covered by the two PBC checks previously subject of the estafa and BP 22 cases. RTC-Manila, dismissed the complaint for lack of jurisdiction, ratiocinating that the civil action to collect the amount of P600,000.00 with damages was already impliedly instituted in the BP Blg 22 cases. Petitioner filed a motion for reconsideration which the court denied in its Order dated June 5, 2006 Issue: Whether petitioner can recover the loaned sum of money and damages? Ruling: Yes. Petitioner may recover under the principle of unjust enrichment. There is unjust enrichment when a person is unjustly benefited, and such benefit is derived at the expense of or with damages to another. Hence, if the loan be proven true, the inability of petitioner to recover the loaned amount would be tantamount to unjust enrichment of the respondents, Executive Secretary vs Court of Appeals 429 SCRA 781 Facts: Republic Act 8042 (Migrant Workers and Overseas Filipino Act of 1995) took effect on 15 July 1995. Prior to its effectivity, Asian Recruitment Council Philippine Chapter Inc (ARCO-Phil) filed petition for declaratory relief. The alleged that: Section 6, subsections (a) to (m) is unconstitutional because licensed and authorized recruitment agencies are placed on equal footing with illegal recruiters. It contended that while the Labor Code distinguished between recruiters who are holders of licenses and non-holders thereof in the imposition of penalties, Rep. Act No. 8042 does not make any distinction. The penalties in Section 7(a) and (b) being based on an invalid classification are, therefore, repugnant to the equal protection clause, besides being excessive; hence, such penalties are violative of Section 19(1), Article III of the Constitution. In their answer to the petition, they contend that ARCO-Phil has no legal standing, it being a non-stock, non-profit organization; hence, not the real party-in-interest as petitioner in the action. It is service-oriented while the recruitment agencies it purports to represent are profit-oriented. Issue: Whether or not ARCO-Phil has legal standing to assail Republic Act 8042? Decision: The modern view is that an association has standing to complain of injuries to its members. This view fuses the legal identity of an association with that of its members. An association has standing to file suit for its workers despite its lack of direct interest if its members are affected by the action. An organization has standing to assert the concerns of its constituents. However, the respondent has no locus standi to file the petition for and in behalf of unskilled workers. We note that it even failed to implead any unskilled workers in its petition. "Locus standi" (place of standing) - the right of the party to appear and be heard before court, or the right of a party to commence an action. LAW

SECOND DIVISION

[ G.R. No. 114791, May 29, 1997 ] NANCY GO AND ALEX GO, PETITIONERS, VS. THE HONORABLE COURT OF APPEALS, HERMOGENES ONG AND JANE C. ONG, RESPONDENTS. D E C I S I O N ROMERO, J.: No less than the Constitution commands us to protect marriage as an inviolable social institution and the foundation of the family.[1] In our society, the importance of a wedding ceremony cannot be underestimated as it is the matrix of the family and, therefore, an occasion worth reliving in the succeeding years. It is in this light that we narrate the following undisputed facts: Private respondents spouses Hermogenes and Jane Ong were married on June 7, 1981, in Dumaguete City. The video coverage of the wedding was provided by petitioners at a contract price of P1,650.00. Three times thereafter, the newlyweds tried to claim the video tape of their wedding, which they planned to show to their relatives in the United States where they were to spend their honeymoon, and thrice they failed because the tape was apparently not yet processed. The parties then agreed that the tape would be ready upon private respondents’ return. When private respondents came home from their honeymoon, however, they found out that the tape had been erased by petitioners and therefore, could no longer be delivered. Furious at the loss of the tape which was supposed to be the only record of their wedding, private respondents filed on September 23, 1981 a complaint for specific performance and damages against petitioners before the Regional Trial Court, 7th Judicial District, Branch 33, Dumaguete City. After a protracted trial, the court a quo rendered a decision, to wit: “WHEREFORE, judgment is hereby granted: 1. Ordering the rescission of the agreement entered into between plaintiff Hermogenes Ong and defendant Nancy Go; 2. Declaring defendants Alex Go and Nancy Go jointly and severally liable to plaintiffs Hermogenes Ong and Jane C. Ong for the following sums: a) P450.00, the down payment made at contract time; b) P75,000.00, as moral damages; c) P20,000.00, as exemplary damages; d) P5,000.00, as attorney’s fees; and e) P2,000.00, as litigation expenses; Defendants are also ordered to pay the costs. SO ORDERED.” Dissatisfied with the decision, petitioners elevated the case to the Court of Appeals which, on September 14, 1993, dismissed the appeal and affirmed the trial court’s decision. Hence, this petition. Petitioners contend that the Court of Appeals erred in not appreciating the evidence they presented to prove that they acted only as agents of a certain Pablo Lim and, as such, should not have been held liable. In addition, they aver that there is no evidence to show that the erasure of the tape was done in bad faith so as to justify the award of damages.[2] The petition is not meritorious. Petitioners claim that for the video coverage, the cameraman was employed by Pablo Lim who also owned the video equipment used. They further assert that they merely get a commission for all customers solicited for their principal.[3] This contention is primarily premised on Article 1883 of the Civil Code which states thus: “ART. 1883. If an agent acts in his own name, the principal has no right of action against the persons with whom the agent has contracted; neither have such persons against the principal. In such case the agent is the one directly bound in favor of the person with whom he has contracted, as if the transaction were his own, except when the contract involves things belonging to the principal. xxx xxx xxx” Petitioners’ argument that since the video equipment used belonged to Lim and thus the contract was actually entered into between private respondents and Lim is not deserving of any serious consideration. In the instant case, the contract entered into is one of service, that is, for the video coverage of the wedding. Consequently, it can hardly be said that the object of the contract was the video equipment used. The use by petitioners of the video equipment of another person is of no consequence. It must also be noted that in the course of the protracted trial below, petitioners did not even present Lim to corroborate their contention that they were mere agents of the latter. It would not be unwarranted to assume that their failure to present such a vital witness would have had an adverse result on the case.[4] As regards the award of damages, petitioners would impress upon this Court their lack of malice or fraudulent intent in the erasure of the tape. They insist that since private respondents did not claim the tape after the lapse of thirty days, as agreed upon in their contract, the erasure was done in consonance with consistent business practice to minimize losses.[5] We are not persuaded. As correctly observed by the Court of Appeals, it is contrary to human nature for any newlywed couple to neglect to claim the video coverage of their wedding; the fact that private respondents filed a case against petitioners belies such assertion. Clearly, petitioners are guilty of actionable delay for having failed to process the video tape. Considering that private respondents were about to leave for the United States, they took care to inform petitioners that they would just claim the tape upon their return two months later. Thus, the erasure of the tape after the lapse of thirty days was unjustified. In this regard, Article 1170 of the Civil Code provides that “those who in the performance of their obligations are guilty of fraud, negligence or delay, and those who is any manner contravene the tenor thereof, are liable for damages.” In the instant case, petitioners and private respondents entered into a contract whereby, for a fee, the former undertook to cover the latter’s wedding and deliver to them a video copy of said event. For whatever reason, petitioners failed to provide private respondents with their tape. Clearly, petitioners are guilty of contravening their obligation to said private respondents and are thus liable for damages. The grant of actual or compensatory damages in the amount of P450.00 is justified, as reimbursement of the downpayment paid by private respondents to petitioners.[6] Generally, moral damages cannot be recovered in an action for breach of contract because this case is not among those enumerated in Article 2219 of the Civil Code. However, it is also accepted in this jurisdiction that liability for a quasi-delict may still exist despite the presence of contractual relations, that is, the act which violates the contract may also constitute a quasi-delict.[7] Consequently, moral damages are recoverable for the breach of contract which was palpably wanton, reckless, malicious or in bad faith, oppresive or abusive.[8] Petitioners’ act or omission in recklessly erasing the video coverage of private respondents’ wedding was precisely the cause of the suffering private respondents had to undergo. As the appellate court aptly observed: “Considering the sentimental value of the tapes and the fact that the event therein recorded — a wedding which in our culture is a significant milestone to be cherished and remembered — could no longer be reenacted and was lost forever, the trial court was correct in awarding the appellees moral damages albeit in the amount of P75,000.00, which was a great reduction from plaintiffs’ demand in the complaint, in compensation for the mental anguish, tortured feelings, sleepless nights and humiliation that the appellees suffered and which under the circumstances could be awarded as allowed under Articles 2217 and 2218 of the Civil Code.”[9] Considering the attendant wanton negligence committed by petitioners in the case at bar, the award of exemplary damages by the trial court is justified[10] to serve as a warning to all entities engaged in the same business to observe due diligence in the conduct of their affairs. The award of attorney’s fees and litigation expenses are likewise proper, consistent with Article 2208[11] of the Civil Code. Finally, petitioner Alex Go questions the finding of the trial and appellate courts holding him jointly and severally liable with his wife Nancy regarding the pecuniary liabilities imposed. He argues that when his wife entered into the contract with private respondent, she was acting alone for her sole interest.[12] We find merit in this contention. Under Article 117 of the Civil Code (now Article 73 of the Family Code), the wife may exercise any profession, occupation or engage in business without the consent of the husband. In the instant case, we are convinced that it was only petitioner Nancy Go who entered into the contract with private respondent. Consequently, we rule that she is solely liable to private respondents for the damages awarded below, pursuant to the principle that contracts produce effect only as between the parties who execute them.[13] WHEREFORE, the assailed decision dated September 14, 1993 is hereby AFFIRMED with the MODIFICATION that petitioner Alex Go is absolved from any liability to private respondents and that petitioner Nancy Go is solely liable to said private respondents for the judgment award. Costs against petitioners. SO ORDERED. Regalado, (Chairman), Puno, Mendoza, and Torres, Jr., JJ., concur. [1] Section 2, Article XV, 1987 Constitution. [2] Rollo, pp. 15-23. [3] Ibid., p. 7. [4] Section 3(e), Rule 131 of the Rules of Court states, "(t)hat evidence willfully suppressed would be adverse if produced." [5] Rollo, p. 19. [6] Article 2200, Civil Code of the Philippines. [7] PARAS, Civil Code of the Philippines, V, 1990, pp. 995-996, Singson v. Bank of the Philippine Islands, 23 SCRA 1117 (1968). [8] TOLENTINO, COMMENTARIES & JURISPRUDENCE ON THE CIVIL CODE OF THE PHILIPPINES, V, 1995, p. 656. [9] Rollo, p. 37. [10] Article 2232, Civil Code of the Philippines. [11] "ART. 2208. In the absence of stipulation, attorney's fees and expenses of litigation, other than judicial costs, cannot be recovered, except: (1) When exemplary damages are awarded; xxx xxx xxx" [12] Rollo, p. 23. [13] Article 1311, Civil Code of the Philippines. SECOND DIVISION

[ G.R. No. 164026, December 23, 2008 ] SECURITIES AND EXCHANGE COMMISSION, PETITIONER, VS. GMA NETWORK, INC., RESPONDENT. D E C I S I O N TINGA, J.: Petitioner Securities and Exchange Commission (SEC) assails the Decision[1] dated February 20, 2004 of the Court of Appeals in CA-G.R. SP No. 68163, which directed that SEC Memorandum Circular No. 1, Series of 1986 should be the basis for computing the filing fee relative to GMA Network, Inc.'s (GMA's) application for the amendment of its articles of incorporation for purposes of extending its corporate term. The undisputed facts as narrated by the appellate court are as follows: On August 19, 1995, the petitioner, GMA NETWORK, INC., (GMA, for brevity), a domestic corporation, filed an application for collective approval of various amendments to its Articles of Incorporation and By-Laws with the respondent Securities and Exchange Commission, (SEC, for brevity). The amendments applied for include, among others, the change in the corporate name of petitioner from "Republic Broadcasting System, Inc." to "GMA Network, Inc." as well as the extension of the corporate term for another fifty (50) years from and after June 16, 2000. Upon such filing, the petitioner had been assessed by the SEC's Corporate and Legal Department a separate filing fee for the application for extension of corporate term equivalent to 1/10 of 1% of its authorized capital stock plus 20% thereof or an amount of P1,212,200.00. On September 26, 1995, the petitioner informed the SEC of its intention to contest the legality and propriety of the said assessment. However, the petitioner requested the SEC to approve the other amendments being requested by the petitioner without being deemed to have withdrawn its application for extension of corporate term. On October 20, 1995, the petitioner formally protested the assessment amounting to P1,212,200.00 for its application for extension of corporate term. On February 20, 1996, the SEC approved the other amendments to the petitioner's Articles of Incorporation, specifically Article 1 thereof referring to the corporate name of the petitioner as well as Article 2 thereof referring to the principal purpose for which the petitioner was formed. On March 19, 1996, the petitioner requested for an official opinion/ruling from the SEC on the validity and propriety of the assessment for application for extension of its corporate term. Consequently, the respondent SEC, through Associate Commissioner Fe Eloisa C. Gloria, on April 18, 1996, issued its ruling upholding the validity of the questioned assessment, the dispositive portion of which states: "In light of the foregoing, we believe that the questioned assessment is in accordance with law. Accordingly, you are hereby required to comply with the required filing fee." An appeal from the aforequoted ruling of the respondent SEC was subsequently taken by the petitioner on the ground that the assessment of filing fees for the petitioner's application for extension of corporate term equivalent to 1/10 of 1% of the authorized capital stock plus 20% thereof is not in accordance with law. On September 26, 2001, following three (3) motions for early resolution filed by the petitioner, the respondent SEC En Banc issued the assailed order dismissing the petitioner's appeal, the dispositive portion of which provides as follows: WHEREFORE, for lack of merit, the instant Appeal is hereby dismissed. SO ORDERED.[2] In its petition for review[3] with the Court of Appeals, GMA argued that its application for the extension of its corporate term is akin to an amendment and not to a filing of new articles of incorporation. It further averred that SEC Memorandum Circular No. 2, Series of 1994, which the SEC used as basis for assessing P1,212,200.00 as filing fee for the extension of GMA's corporate term, is not valid. The appellate court agreed with the SEC's submission that an extension of the corporate term is a grant of a fresh license for a corporation to act as a juridical being endowed with the powers expressly bestowed by the State. As such, it is not an ordinary amendment but is analogous to the filing of new articles of incorporation. However, the Court of Appeals ruled that Memorandum Circular No. 2, Series of 1994 is legally invalid and ineffective for not having been published in accordance with law. The challenged memorandum circular, according to the appellate court, is not merely an internal or interpretative rule, but affects the public in general. Hence, its publication is required for its effectivity. The appellate court denied reconsideration in a Resolution[4] dated June 9, 2004. In its Memorandum[5] dated September 6, 2005, the SEC argues that it issued the questioned memorandum circular in the exercise of its delegated legislative power to fix fees and charges. The filing fees required by it are allegedly uniformly imposed on the transacting public and are essential to its supervisory and regulatory functions. The fees are not a form of penalty or sanction and, therefore, require no publication. For its part, GMA points out in its Memorandum,[6] dated September 23, 2005, that SEC Memorandum Circular No. 1, Series of 1986 refers to the filing fees for amended articles of incorporation where the amendment consists of extending the term of corporate existence. The questioned circular, on the other hand, refers only to filing fees for articles of incorporation. Thus, GMA argues that the former circular, being the one that specifically treats of applications for the extension of corporate term, should apply to its case. Assuming that Memorandum Circular No. 2, Series of 1994 is applicable, GMA avers that the latter did not take effect and cannot be the basis for the imposition of the fees stated therein for the reasons that it was neither filed with the University of the Philippines Law Center nor published either in the Official Gazette or in a newspaper of general circulation as required under existing laws. It should be mentioned at the outset that the authority of the SEC to collect and receive fees as authorized by law is not in question.[7] Its power to collect fees for examining and filing articles of incorporation and by-laws and amendments thereto, certificates of increase or decrease of the capital stock, among others, is recognized. Likewise established is its power under Sec. 7 of P.D. No. 902-A to recommend to the President the revision, alteration, amendment or adjustment of the charges which it is authorized to collect. The subject of the present inquiry is not the authority of the SEC to collect and receive fees and charges, but rather the validity of its imposition on the basis of a memorandum circular which, the Court of Appeals held, is ineffective. Republic Act No. 3531 (R.A. No. 3531) provides that where the amendment consists in extending the term of corporate existence, the SEC "shall be entitled to collect and receive for the filing of the amended articles of incorporation the same fees collectible under existing law as the filing of articles of incorporation."[8] As is clearly the import of this law, the SEC shall be entitled to collect and receive the same fees it assesses and collects both for the filing of articles of incorporation and the filing of an amended articles of incorporation for purposes of extending the term of corporate existence. The SEC, effectuating its mandate under the aforequoted law and other pertinent laws,[9] issued SEC Memorandum Circular No. 1, Series of 1986, imposing the filing fee of 1/10 of 1% of the authorized capital stock but not less than P300.00 nor more than P100,000.00 for stock corporations, and 1/10 of 1% of the authorized capital stock but not less than P200.00 nor more than P100,000.00 for stock corporations without par value, for the filing of amended articles of incorporation where the amendment consists of extending the term of corporate existence. Several years after, the SEC issued Memorandum Circular No. 2, Series of 1994, imposing new fees and charges and deleting the maximum filing fee set forth in SEC Circular No. 1, Series of 1986, such that the fee for the filing of articles of incorporation became 1/10 of 1% of the authorized capital stock plus 20% thereof but not less than P500.00. A reading of the two circulars readily reveals that they indeed pertain to different matters, as GMA points out. SEC Memorandum Circular No. 1, Series of 1986 refers to the filing fee for the amendment of articles of incorporation to extend corporate life, while Memorandum Circular No. 2, Series of 1994 pertains to the filing fee for articles of incorporation. Thus, as GMA argues, the former circular, being squarely applicable and, more importantly, being more favorable to it, should be followed. What this proposition fails to consider, however, is the clear directive of R.A. No. 3531 to impose the same fees for the filing of articles of incorporation and the filing of amended articles of incorporation to reflect an extension of corporate term. R.A. No. 3531 provides an unmistakable standard which should guide the SEC in fixing and imposing its rates and fees. If such mandate were the only consideration, the Court would have been inclined to rule that the SEC was correct in imposing the filing fees as outlined in the questioned memorandum circular, GMA's argument notwithstanding. However, we agree with the Court of Appeals that the questioned memorandum circular is invalid as it does not appear from the records that it has been published in the Official Gazette or in a newspaper of general circulation. Executive Order No. 200, which repealed Art. 2 of the Civil Code, provides that "laws shall take effect after fifteen days following the completion of their publication either in the Official Gazette or in a newspaper of general circulation in the Philippines, unless it is otherwise provided." In Tañada v. Tuvera,[10] the Court, expounding on the publication requirement, held: We hold therefore that all statutes, including those of local application and private laws, shall be published as a condition for their effectivity, which shall begin fifteen days after publication unless a different effectivity date is fixed by the legislature. Covered by this rule are presidential decrees and executive orders promulgated by the President in the exercise of legislative powers whenever the same are validly delegated by the legislature, or, at present, directly conferred by the Constitution. Administrative rules and regulations must also be published if their purpose is to enforce or implement existing law pursuant also to a valid delegation. Interpretative regulations and those merely internal in nature, that is, regulating only the personnel of the administrative agency and not the public, need not be published. Neither is publication required of the so-called letters of instructions issued by administrative superiors concerning the rules or guidelines to be followed by their subordinates in the performance of their duties.[11] The questioned memorandum circular, furthermore, has not been filed with the Office of the National Administrative Register of the University of the Philippines Law Center as required in the Administr ative Code of 1987.[12] In Philsa International Placement and Services Corp. v. Secretary of Labor and Employment,[13] Memorandum Circular No. 2, Series of 1983 of the Philippine Overseas Employment Administration, which provided for the schedule of placement and documentation fees for private employment agencies or authority holders, was struck down as it was not published or filed with the National Administrative Register. The questioned memorandum circular, it should be emphasized, cannot be construed as simply interpretative of R.A. No. 3531. This administrative issuance is an implementation of the mandate of R.A. No. 3531 and indubitably regulates and affects the public at large. It cannot, therefore, be considered a mere internal rule or regulation, nor an interpretation of the law, but a rule which must be declared ineffective as it was neither published nor filed with the Office of the National Administrative Register. A related factor which precludes consideration of the questioned issuance as interpretative in nature merely is the fact the SEC's assessment amounting to P1,212,200.00 is exceedingly unreasonable and amounts to an imposition. A filing fee, by legal definition, is that charged by a public official to accept a document for processing. The fee should be just, fair, and proportionate to the service for which the fee is being collected, in this case, the examination and verification of the documents submitted by GMA to warrant an extension of its corporate term. Rate-fixing is a legislative function which concededly has been delegated to the SEC by R.A. No. 3531 and other pertinent laws. The due process clause, however, permits the courts to determine whether the regulation issued by the SEC is reasonable and within the bounds of its rate-fixing authority and to strike it down when it arbitrarily infringes on a person's right to property. WHEREFORE, the petition is DENIED. The Decision of the Court of Appeals in CA-G.R. SP No. 68163, dated February 20, 2004, and its Resolution, dated June 9, 2004, are AFFIRMED. No pronouncement as to costs. SO ORDERED. Quisumbing, (Chairperson), Carpio Morales, *Chico-Nazario and Velasco, Jr., JJ., concur. * Additional member in lieu of Associate Justice Arturo D. Brion per Special Order. [1] Rollo, pp. 10-19; Penned by Associate Justice Amelita G. Tolentino and concurred in by Associate Justices Eloy R. Bello, Jr. and Arturo D. Brion (now an Associate Justice of this Court). [2] Id. at 11-12. [3] Id. at 91-115. [4] Id. at 57. [5] Id. at 196-221. [6] Id. at 231-249. [7] Sec. 139 of B.P. Blg. 68 authorizes the SEC to collect and receive fees as authorized by law or by rules and regulations promulgated by it. [8] An Act to Further Amend Section Eighteen of the Corporation Law. x x x The Securities and Exchange Commissioner shall be entitled to collect and receive the sum of ten pesos for filing said copy of the amended articles of incorporation: Provided, however, That where the amendment consists in extending the term of corporate existence the Securities and Exchange Commissioner shall be entitled to collect and receive for the filing of the amended articles of incorporation the same fees collectible under existing law for the filing of articles of incorporation. x x x R.A. No. 3531 took effect on June 20, 1963. [9] Presidential Decree 902-A, R.A. No. 1143, and the Revised Securities Act. [10] 230 Phil. 528 (1986). [11] Id. at 535. [12] Executive Order No. 292, Book VII, Chapter 2, Sec. 3 thereof states: Sec. 3. Filing.--(1) Every agency shall file with the University of the Philippines Law Center three (3) certified copies of every rule adopted by it. Rules in force on the date of effectivity of this Code which are not filed within three (3) months from that date shall not thereafter be the basis of any sanction against any party or persons. (2) The records officer of the agency, or his equivalent functionary, shall carry out the requirements of this section under pain of disciplinary action. (3) A permanent register of all rules shall be kept by the issuing agency and shall be open to public inspection. [13] 408 Phil. 270 (2001) cited in National Association of Electricity Consumers for Reforms (NASECORE) v. Energy Regulatory Commission, G.R. No. 163935, February 2, 2006, 481 SCRA 480, 520. THIRD DIVISION

[ G.R. No. 173918, April 08, 2008 ] REPUBLIC OF THE PHILIPPINES, represented by the DEPARTMENT OF ENERGY (DOE), Petitioner, vs. PILIPINAS SHELL PETROLEUM CORPORATION, Respondent. D E C I S I O N CHICO-NAZARIO, J.: This is a Petition for Review on Certiorari under Rule 45 of the Rules of Court, assailing the Decision dated 4 August 2006 of the Court of Appeals in C.A. G.R. SP No. 82183.[1] The appellate court reversed the Decision[2] dated 19 August 2003 of the Office of the President in OP NO. Case 96-H-6574 and declared that Ministry of Finance (MOF) Circular No. 1-85 dated 15 April 1985, as amended, is ineffective for failure to comply with Section 3 of Chapter 2, Book 7 of the Administrative Code of 1987,[3] which requires the publication and filing in the Office of the National Administration Register (ONAR) of administrative issuances. Thus, surcharges provided under the aforementioned circular cannot be imposed upon respondent Pilipinas Shell Petroleum Corporation. Respondent is a corporation duly organized existing under the laws of the Philippines. It is engaged in the business of refining oil, marketing petroleum, and other related activities.[4] The Department of Energy (DOE) is a government agency under the direct control and supervision of the Office of the President. The Department is mandated by Republic Act No. 7638 to prepare, integrate, coordinate, supervise and control all plans, programs, projects and activities of the Government relative to energy exploration, development, utilization, distribution and conservation. On 10 October 1984, the Oil Price Stabilization Fund (OPSF) was created under Presidential Decree No. 1956 for the purpose of minimizing frequent price changes brought about by exchange rate adjustments and/or increase in world market prices of crude oil and imported petroleum products.[5] Letter of Instruction No. 1431 dated 15 October 1984 was issued directing the utilization of the OPSF to reimburse oil companies the additional costs of importation of crude oil and petroleum products due to fluctuation in foreign exchange rates to assure adequate and continuous supply of petroleum products at reasonable prices.[6] Letter of Instruction No. 1441, issued on 20 November 1984, mandated the Board of Energy (now, the Energy Regulatory Board) to review and reset prices of domestic oil products every two months to reflect the prevailing prices of crude oil and petroleum. The prices were regulated by adjusting the OPSF impost, increasing or decreasing this price component as necessary to maintain the balance between revenues and claims on the OPSF.[7] On 27 February 1987, Executive Order No. 137 was enacted to amend P. D. No. 1956. It expanded the sources and utilization of the OPSF in order to maintain stability in the domestic prices of oil products at reasonable levels.[8] On 4 December 1991, the Office of Energy Affairs (OEA), now the DOE, informed the respondent that respondent’s contributions to the OPSF for foreign exchange risk charge for the period December 1989 to March 1991 were insufficient. OEA Audit Task Force noted a total underpayment of P14,414,860.75 by respondent to the OPSF. As a consequence of the underpayment, a surcharge of P11,654,782.31 was imposed upon respondent. The said surcharge was imposed pursuant to MOF Circular No. 1-85, as amended by Department of Finance (DOF) Circular No. 2-94,[9] which provides that: 2. Remittance of payment to the OPSF as provided for under Section 5 of MOF Order No. 11-85 shall be made not later than 20th of the month following the month of remittance of the foreign exchange payment for the import or the month of payment to the domestic producers in the case of locally produced crude. Payment after the specified date shall be subject to a surcharge of fifteen percent (15%) of the amount, if paid within thirty (30) days from the due date plus two percent (2%) per month if paid after thirty days.[10] (Emphasis supplied.) On 9 December 1991, the OEA wrote another letter[11] to respondent advising the latter of its additional underpayment to the OPSF of the foreign exchange risk fee in the amount of P10,139,526.56 for the period April 1991 to October 1991. In addition, surcharges in the amount of P2,806,656.65 were imposed thereon. In a letter dated 20 January 1992 addressed to the OEA, respondent justified that its calculations for the transactions in question were based on a valid interpretation of MOF Order NO. 11-85 dated 12 April 1985 and MOE Circular No. 85-05-82 dated 16 May 1985.[12] On 24 March 1992, respondent paid the OEA in full the principal amount of its underpayment, totaling P24,554,387.31, but not the surcharges.[13] In a letter[14] dated 15 March 1996, OEA notified the respondent that the latter is required to pay the OPSF a total amount of P18,535,531.40 for surcharges on the late payment of foreign exchange risk charges for the period December 1989 to October 1991. In a letter[15] dated 11 July 1996, the DOE reiterated its demand for respondent to settle the surcharges due. Otherwise, the DOE warned that it would proceed against the respondent’s Irrevocable Standby Letter of Credit to recover its unpaid surcharges. On 19 July 1996, respondent filed a Notice of Appeal before the Office of the President. The Office of the President affirmed the conclusion of the DOE, contained in its letters dated 15 March 1996 and 11 July 1996. While it admitted that the implementation of MOF Circular No. 1-85 is contingent upon its publication and filing with the ONAR, it noted that respondent failed to adduce evidence of lack of compliance with such requirements. The aforementioned Decision reads:[16] Given the foregoing, the DOE’s implementation of MOF Circular 1-85 by imposing surcharges on Pilipinas Shell is only proper. Like this Office, the DOE is bound to presume the validity of that administrative regulation. WHEREFORE, premises considered, the Decision of the Department of Energy, contained in its letters dated 15 March 1996 and 11 July 1996, is hereby AFFIRMED in toto. Respondent filed a Motion for Reconsideration of the Decision dated 19 August 2003 of the Office of the President, which was denied on 28 November 2003.[17] Respondent filed an appeal before the Court of Appeals wherein it presented Certifications dated 9 February 2004[18] and 11 February 2004[19] issued by ONAR stating that DOF Circular No. 2-94 and MOF Circular No. 1-85 respectively, have not been filed before said office. The Court of Appeals reversed the Decision of the Office of the President in O.P. CASE No. 96-H-6574 and ruled that MOF Circular 1-85, as amended, was ineffective for failure to comply with the requirement to file with ONAR. It decreed that even if the said circular was issued by then Acting Minister of Finance Alfredo de Roda, Jr. long before the Administrative Code of 1987, Section 3 of Chapter 2, Book 7 thereof specifies that rules already in force on the date of the effectivity of the Administrative Code of 1987 must be filed within three months from the date of effectivity of said Code, otherwise such rules cannot thereafter be the basis of any sanction against any party or persons.[20]According to the dispositive of the appellate court’s Decision:[21] WHEREFORE, the instant petition is hereby GRANTED. The Decision dated August 19, 2003 and the Resolution dated November 28, 2003 of the Office of the President, are hereby REVERSED. ACCORDINGLY, the imposition of surcharges upon petitioner is hereby declared without legal basis. On 25 September 2006, petitioner filed the present Petition for Review on Certiorari, wherein the following issues were raised:[22] I THE SURCHARGE IMPOSED BY MINISTRY OF FINANCE (MOF) CIRCULAR No. 1-85 HAS BEEN AFFIRMED BY E.O. NO. 137 HAVING RECEIVED VITALITY FROM A LEGISLATIVE ENACTMENT, MOF CIRCULAR NO. 1-85 CANNOT BE RENDERED INVALID BY THE SUBSEQUENT ENACTMENT OF A LAW REQUIRING REGISTRATION OF THE MOF CIRCULAR WITH THE OFFICE OF THE NATIONAL REGISTER II ASSUMING THAT THE REGISTRATION OF MOF NO. 1-85 IS REQUIRED, RESPONDENT WAIVED ITS OBJECTION ON THE BASIS OF NON-REGISTRATION WHEN IT PAID THE AMOUNT REQUIRED BY PETITIONER. This petition is without merit. As early as 1986, this Court in Tañada v. Tuvera[23] enunciated that publication is indispensable in order that all statutes, including administrative rules that are intended to enforce or implement existing laws, attain binding force and effect, to wit: We hold therefore that all statutes, including those of local application and private laws, shall be published as a condition for their effectivity, which shall begin fifteen days after publication unless a different effectivity date is fixed by the legislature. Covered by this rule are presidential decrees and executive orders promulgated by the President in the exercise of legislative powers whenever the same are validly delegated by the legislature or, at present, directly conferred by the Constitution. Administrative rules and regulations must also be published if their purpose is to enforce or implement existing law pursuant also to a valid delegation. (Emphasis provided.) Thereafter, the Administrative Code of 1987 was enacted, with Section 3 of Chapter 2, Book VII thereof specifically providing that: Filing.—(1) Every agency shall file with the University of the Philippines Law Center three (3) certified copies of every rule adopted by it. Rules in force on the date of effectivity of this Code which are not filed within three (3) months from the date shall not thereafter be the basis of any sanction against any party or persons. (2) The records officer of the agency, or his equivalent functionary, shall carry out the requirements of this section under pain of disciplinary action. (3) A permanent register of all rules shall be kept by the issuing agency and shall be open to public inspection. (Emphasis provided.) Under the doctrine of Tanada v. Tuvera,[24] the MOF Circular No. 1-85, as amended, is one of those issuances which should be published before it becomes effective since it is intended to enforce Presidential Decree No. 1956. The said circular should also comply with the requirement stated under Section 3 of Chapter 2, Book VII of the Administrative Code of 1987 – filing with the ONAR in the University of the Philippines Law Center – for rules that are already in force at the time the Administrative Code of 1987 became effective. These requirements of publication and filing were put in place as safeguards against abuses on the part of lawmakers and as guarantees to the constitutional right to due process and to information on matters of public concern and, therefore, require strict compliance. In the present case, the Certifications dated 11 February 2004[25] and 9 February 2004[26] issued by ONAR prove that MOF Circular No. 1-85 and its amendatory rule, DOF Circular No. 2-94, have not been filed before said office. Moreover, petitioner was unable to controvert respondent’s allegation that neither of the aforementioned circulars were published in the Official Gazette or in any newspaper of general circulation. Thus, failure to comply with the requirements of publication and filing of administrative issuances renders MOF Circular No. 1-85, as amended, ineffective. In National Association of Electricity Consumers for Reforms v. Energy Regulatory Board,[27] this Court emphasized that both the requirements of publication and filing of administrative issuances intended to enforce existing laws are mandatory for the effectivity of said issuances. In support of its ruling, it specified several instances wherein this Court declared administrative issuances, which failed to observe the proper requirements, to have no force and effect: Nowhere from the above narration does it show that the GRAM Implementing Rules was published in the Official Gazette or in a newspaper of general circulation. Significantly, the effectivity clauses of both the GRAM and ICERA Implementing Rules uniformly provide that they “shall take effect immediately.” These clauses made no mention of their publication in either the Official Gazette or in a newspaper of general circulation. Moreover, per the Certification dated January 11, 2006 of the Office of the National Administrative Register (ONAR), the said implementing rules and regulations were not likewise filed with the said office in contravention of the Administrative Code of 1987. Applying the doctrine enunciated in Tañada v. Tuvera, the Court has previously declared as having no force and effect the following administrative issuances: (1) Rules and Regulations issued by the Joint Ministry of Health-Ministry of Labor and Employment Accreditation Committee regarding the accreditation of hospitals, medical clinics and laboratories; (2) Letter of Instruction No. 1416 ordering the suspension of payments due and payable by distressed copper mining companies to the national government; (3) Memorandum Circulars issued by the Philippine Overseas Employment Administration regulating the recruitment of domestic helpers to Hong Kong; (4) Administrative Order No. SOCPEC 89-08-01 issued by the Philippine International Trading Corporation regulating applications for importation from the People’s Republic of China; (5) Corporation Compensation Circular No. 10 issued by the Department of Budget and Management discontinuing the payment of other allowances and fringe benefits to government officials and employees; and (6) POEA Memorandum Circular No. 2 Series of 1983 which provided for the schedule of placement and documentation fees for private employment agencies or authority holders. In all these cited cases, the administrative issuances questioned therein were uniformly struck down as they were not published or filed with the National Administrative Register. On the other hand, in Republic v. Express Telecommunications Co., Inc, the Court declared that the 1993 Revised Rules of the National Telecommunications Commission had not become effective despite the fact that it was filed with the National Administrative Register because the same had not been published at the time. The Court emphasized therein that “publication in the Official Gazette or a newspaper of general circulation is a condition sine qua non before statutes, rules or regulations can take effect.” Petitioner’s argument that respondent waived the requisite registration of MOF Circular No. 1-85, as amended, when it paid in full the principal amount of underpayment totaling P24,544,387.31, is specious. MOF Circular No. 1-85, as amended imposes surcharges, while respondents’ underpayment is based on MOF Circular No. 11-85 dated 12 April 1985. Petitioner also insists that the registration of MOF Circular No. 1-85, as amended, with the ONAR is no longer necessary since the respondent knew of its existence, despite its non-registration. This argument is seriously flawed and contrary to jurisprudence. Strict compliance with the requirements of publication cannot be annulled by a mere allegation that parties were notified of the existence of the implementing rules concerned. Hence, also in National Association of Electricity Consumers for Reforms v. Energy Regulatory Board, this Court pronounced: In this case, the GRAM Implementing Rules must be declared ineffective as the same was never published or filed with the National Administrative Register. To show that there was compliance with the publication requirement, respondents MERALCO and the ERC dwell lengthily on the fact that parties, particularly the distribution utilities and consumer groups, were duly notified of the public consultation on the ERC’s proposed implementing rules. These parties participated in the said public consultation and even submitted their comments thereon. However, the fact that the parties participated in the public consultation and submitted their respective comments is not compliance with the fundamental rule that the GRAM Implementing Rules, or any administrative rules whose purpose is to enforce or implement existing law, must be published in the Official Gazette or in a newspaper of general circulation. The requirement of publication of implementing rules of statutes is mandatory and may not be dispensed with altogether even if, as in this case, there was public consultation and submission by the parties of their comments.[28] (Emphasis provided.) Petitioner further avers that MOF Circular No. 1-85, as amended, gains its vitality from the subsequent enactment of Executive Order No. 137, which reiterates the power of then Minister of Finance to promulgate the necessary rules and regulations to implement the executive order. Such contention is irrelevant in the present case since the power of the Minister of Finance to promulgate rules and regulations is not under dispute. The issue rather in the Petition at bar is the ineffectivity of his administrative issuance for non-compliance with the requisite publication and filing with the ONAR. And while MOF Circular No. 1-85, as amended, may be unimpeachable in substance, the due process requirements of publication and filing cannot be disregarded. Moreover, none of the provisions of Executive Order No. 137 exempts MOF Circular No. 1-85, as amended from the aforementioned requirements. IN VIEW OF THE FOREGOING, the instant Petition is DENIED and the assailed Decision dated 4 August 2006 of the Court of Appeals in C.A. G.R. SP No. 82183 is AFFIRMED. No cost. SO ORDERED. Austria-Martinez, (Acting Chairperson), Carpio-Morales, Tinga, and Reyes, JJ., concur. * Assigned as Special Member. [1] Penned by Associate Justice Monina Arevalo-Zeñarosa with Associate Justices Renato C. Dacudao and Rosmari D. Carandang, concurring. Rollo, pp. 55 -74. [2] Id. at 301-303. [3] Section 3 of Chapter 2, Book VII of the Administrative Code of 1987 states that: Filing.— (1) Every agency shall file with the University of the Philippines Law Center three (3) certified copies of every rule adopted by it. Rules in force on the date of effectivity of this Code which are not filed within three (3) months from the date shall not thereafter be the basis of any sanction against any party or persons. (2) The records officer of the agency, or his equivalent functionary, shall carry out the requirements of this section under pain of disciplinary action. (3) A permanent register of all rules shall be kept by the issuing agency and shall be open to public inspection. [4] Rollo, p. 63. [5] Section 8 of Presidential Decree No. 1956 states that: SECTION 8. There is hereby created a Special Account in the General Fund to be designated as Oil Price Stabilization Fund for the purpose of minimizing frequent price changes brought about by exchange rate adjustments and/or an increase in world market prices of crude oil and imported petroleum products. The Fund may be sourced from any of the following: (a) Any increase in the tax collection from ad-valorem tax or customs duty imposed on petroleum products subject to tax under this Decree arising from exchange rate adjustment, as may be determined by the Minister of Finance in consultation with the Board of Energy; (b) Any increase in the tax collection as a result of the lifting of tax exemptions of government corporations under Presidential Decree No. 1931, as may be determined by the Minister of Finance in consultation with the Board of Energy; (c) Any additional tax to be imposed on petroleum products to augment the resources of the Fund through an appropriate Order that may be issued by the Board of Energy requiring payment by persons or companies engaged in the business of importing, manufacturing and/or marketing petroleum products. The Fund created herein shall be used to reimburse the oil companies for cost increases on crude oil and imported petroleum products resulting from exchange rate adjustment and/or increase in world market prices of crude oil. The Fund shall be administered by the Ministry of Energy. [6] Rollo, p. 301. [7] Id. at 56-57. [8] Section 1 of Executive Order No. 137 provides that: SECTION 1. Section 8 of Presidential Decree No. 1956 is hereby amended to read as follows: “SECTION 8. There is hereby created a Trust Account in the books of accounts of the Ministry of Energy to be designated as Oil Price Stabilization Fund (OPSF) for the purpose of minimizing frequent price changes brought about by exchange rate adjustments and/or changes in world market prices on crude oil and imported petroleum products. The Oil Price Stabilization Fund (OPSF) may be sourced from any of the following: a) Any increase in the tax collection from ad valorem tax or customs duty imposed on petroleum products subject to tax under this Decree arising from exchange rate adjustment, as may be determined by the Minister of Finance in consultation with the Board of Energy; b) Any increase in the tax collection as a result of the lifting of tax exemptions of government corporations, as may be determined by the Minister of Finance in consultation with the Board of Energy; c) Any Additional amount to be imposed on petroleum products to augment the resources of the Fund through an appropriate Order that may be issued by the Board of Energy requiring payment by persons or companies engaged in the business of importing, manufacturing and/or marketing petroleum products; d) Any resulting peso cost differentials in case the actual peso costs paid by oil companies in the importation of crude oil and petroleum products is less than the peso costs computed using the reference foreign exchange rate as fixed by the Board of Energy. The Fund herein created shall be used for the following:

[9] Rollo, p. 77. [10] Id. at 76. [11] Id. at 78. [12] Ministry of Finance (MOF) Order No. 11-85 dated 12 April 1985 provides for payment of foreign exchange risk charge “based on the actual peso value of the foreign exchange payment for the shipment” and Ministry of Energy (MOE) Circular No. 85-05-82 dated 16 May 1985 prescribing supplemental rule and regulations to MOF Order No. 11-85 which provides, among others, that the risk charge “shall cover all crude oil and imported finished petroluem fuel credits outstanding xxx.” Id. at 79-80. [13] Id. at 302. [14] Id. at 81-82. [15] Id. at 98. [16] Id. at 303. [17] Id. at 304. [18] Id. at 231. [19] Id. at 230. [20] Id. at 72-73. [21] Id. at 73-74. [22] Id. at 349. [23] Tañada v. Tuvera, G.R. No. L-63915, 29 December 1986, 146 SCRA 446, 453-454. [24] Id. [25] Rollo, p. 230. [26] Id. at 231. [27] National Association of Electricity Consumers for Reforms v. Energy Regulatory Commission, G.R. No. 163935, 2 February 2006, 481 SCRA 480, 519-521. [28] Id. at 521. Republic of the Philippines